BTC Price Prediction: $150K in Sight as Technicals and Fundamentals Align

#BTC

- Technical Strength: Price above key MAs with improving momentum indicators

- Institutional Demand: Major corporations and nations accumulating BTC

- Macro Tailwinds: Fed policy and digital gold narrative creating favorable conditions

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge Amid Consolidation

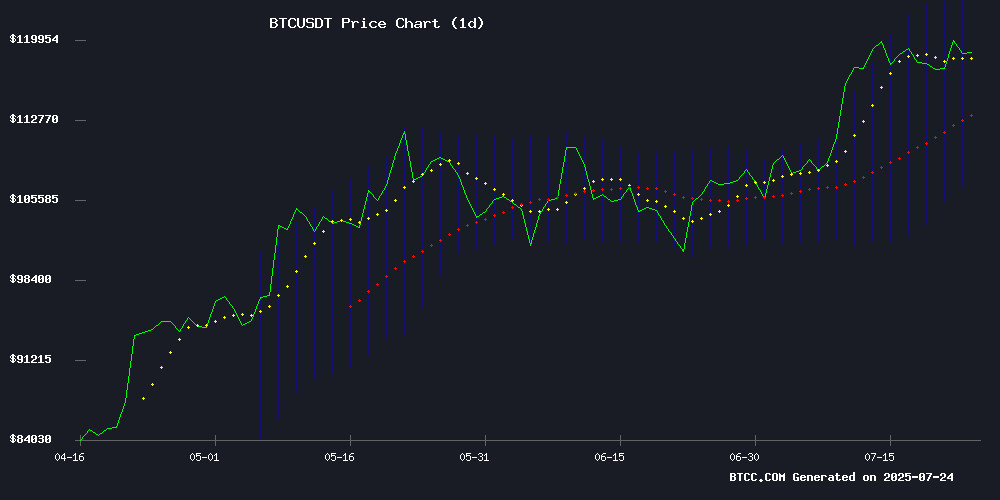

According to BTCC financial analyst William, BTC is currently trading at, above its 20-day moving average (), indicating a bullish trend. The MACD histogram shows a slight positive crossover (), suggesting potential upward momentum. Bollinger Bands reveal price hovering NEAR the upper band (), which may act as resistance.William notes.

Market Sentiment: Institutional Adoption Fuels BTC Optimism

BTCC's William highlights strong bullish catalysts from recent news:

- Tesla's $1.2B BTC holdings demonstrate corporate confidence

- Japan's Kitabo adopting BTC as treasury reserve

- Institutional 'digital gold' narrative gaining traction

Factors Influencing BTC’s Price

Bitcoin Flow Pulse Diverges From 2017 and 2021 Patterns, Signaling Sustained Rally

Bitcoin's Inter-Exchange Flow Pulse (IFP) indicator reveals a striking departure from historical sell-off trends as BTC hovers NEAR its all-time high of $123,218. Unlike the 2017 and 2021 bull runs, exchange deposits remain subdued despite record prices—suggesting stronger hodling sentiment among large investors.

CryptoQuant data shows the IFP metric, which tracks BTC movements between wallets and exchanges, hasn't triggered the customary sell pressure that preceded previous corrections. The absence of mass profit-taking echoes through the market as Bitcoin consolidates rather than retreats from its highs.

Market veterans note this anomaly could reflect growing institutional confidence or anticipation of further upside. "When whales don't sell at ATHs, they're either seeing parabolic targets or building long-term positions," observed Arab Chain, the analyst who first flagged the trend.

Bitcoin Eyes $150,000 as Bullish Momentum Persists

Bitcoin’s trajectory toward $150,000 gains credibility as the cryptocurrency holds firm above critical moving averages. Trading steadily near $120,000, BTC demonstrates resilience despite short-term fluctuations. The consolidation phase appears healthy, with technical indicators supporting further upside.

The daily chart reveals a robust ascending structure, with consistent rebounds from the 26- and 50-day EMAs. A recent breakout from a symmetrical triangle near $107,000 propelled prices to a $123,000 peak, followed by a flag formation—a classic continuation pattern. Volume has tapered post-breakout, typical of consolidation, while the RSI remains firmly above 60, reflecting sustained bullish momentum.

Market sentiment increasingly views $150,000 as Bitcoin’s next magnet level, with scant resistance expected between $120,000 and $135,000. Outperforming traditional assets in both momentum and capital inflows, BTC solidifies its dual role as a tech-driven growth asset and macro hedge. Barring unforeseen disruptions, the march toward $150,000 appears inevitable—only timing remains uncertain.

Tesla’s Bitcoin Holdings Surge to $1.2 Billion Amid Price Rally

Tesla’s bitcoin reserves have surged to $1.2 billion as BTC climbed 30% in Q2 2025, according to the company’s earnings report. The automaker now holds 11,509 BTC, securing its position as the tenth-largest publicly traded firm with bitcoin on its balance sheet.

Bitcoin’s rally to $118,000—up from $83,000 in early April—coincides with a pivotal accounting shift by the U.S. Financial Accounting Standards Board. The new rules, effective since Q1 2025, require companies to report digital assets at fair market value quarterly, replacing the previous method of recording holdings at their lowest value during the reporting period.

Tesla’s Q2 revenue reached $22.5 billion, slightly exceeding analyst estimates, while EPS matched projections at $0.40. Shares rose 0.71% in after-hours trading to $331.56. The updated accounting standards provide shareholders with clearer insights into crypto holdings, potentially encouraging broader corporate adoption.

Japan’s Kitabo Adopts Bitcoin Treasury Strategy Amid Financial Struggles

Kitabo Co., Ltd, a Tokyo Stock Exchange-listed manufacturer of synthetic fiber spun yarns, has announced its shift to Bitcoin as part of its treasury reserves. The firm plans to allocate ¥800 million ($5.4 million) to Bitcoin purchases through dollar-cost averaging (DCA), aiming to stabilize its finances after reporting a ¥115.6 million ($785,000) net loss in fiscal 2024.

The MOVE positions Kitabo among a growing list of Japanese companies embracing Bitcoin as a hedge against currency devaluation. The company will fund its Bitcoin acquisitions through local exchanges using capital raised from its fourth Series of Stock Acquisition Rights. Beyond treasury holdings, Kitabo intends to leverage Bitcoin for cross-border transactions and international partnerships.

This strategic pivot marks Kitabo's formal entry into cryptocurrency and real-world asset operations. The decision reflects broader corporate trends in Asia, where Bitcoin's store-of-value properties are increasingly recognized amidst economic uncertainty.

Bitcoin's Evolution into Digital Gold Gains Institutional Endorsement

Anthony Scaramucci, founder of SkyBridge Capital, positions Bitcoin as the digital era's answer to Gold during a Bloomberg interview. The cryptocurrency's maturation from speculative tech asset to inflation hedge reflects deepening institutional engagement.

Public companies now accumulate BTC alongside sovereign wealth funds and asset managers—a strategic shift recognizing its store-of-value properties. Scaramucci's commentary underscores Bitcoin's dual role: technological innovation and monetary safeguard against currency debasement.

U.S. Government Holds 198,000 BTC Despite Confusion Over Reserves

Arkham Intelligence has dispelled rumors of depleted U.S. government Bitcoin reserves, confirming holdings of at least 198,000 BTC across multiple agencies. The blockchain data firm clarified that none of these funds have moved in the past four months, with the stash valued at roughly $23.5 billion.

Confusion arose after a U.S. Marshals Service document revealed holdings of just 28,988 BTC, prompting Senator Cynthia Lummis to voice concerns about a potential strategic blunder. "This sets the United States back years in the bitcoin race," she wrote, reacting to initial reports suggesting an 80% sell-off.

The discrepancy stems from fragmented holdings across different government entities. While the Marshals Service manages a portion, other agencies control separate wallets containing the bulk of the reserves. Arkham's analysis provides the first comprehensive look at these distributed holdings since the Silk Road seizures.

Bitcoin Price Prediction: Tom Lee Forecasts $1 Million BTC as 'Digital Gold' Narrative Gains Traction

Bitcoin's resilience as a store of value continues to draw comparisons to gold, with Fundstrat's Tom Lee reiterating a long-term price target of $1-3 million per BTC. The analyst emphasized Bitcoin's growing institutional recognition during a CNBC interview, citing its potential to capture 25% of gold's market capitalization at $200,000-$250,000.

Regulatory tailwinds like the GENIUS Act are seen as catalysts for broader crypto adoption. Lee's bullish stance aligns with increasing institutional interest, as the US Treasury's 2025 report formally acknowledged Bitcoin's role in the digital asset ecosystem.

Crypto Market’s Fate Hangs On The Last Days Of July

Bitcoin hovers just below its mid-May record at roughly $119,000, while the global crypto-asset capitalisation approaches $4 trillion. Traders warn the real test will come in the last week of July, when a cluster of US macro-policy events collides with a legal battle over President Trump’s tariffs.

The Federal Open Market Committee meeting on 29–30 July takes center stage. Governor Christopher Waller recently laid the groundwork for a potential 25-basis-point rate cut, citing "temporary" tariff-linked inflation and a strained labor market. Prediction markets price in a 40% chance of two cuts by December.

Simultaneously, the Supreme Court will deliberate the legality of executive-ordered tariffs. "The last few days of July will set the stage for markets for the rest of the year," noted Forward Guidance host Felix Jauvin, highlighting the convergence of Treasury issuance decisions and tariff policy uncertainty.

Bitcoin Price Awaits Fed Decision as Rally Hangs in Balance

Bitcoin hovers near $120,000, teetering between record highs and potential pullback as traders brace for the Federal Reserve's July 30 policy meeting. The cryptocurrency's 8% retreat from its $123,218 peak contrasts with elevated spot volumes and open interest—a classic tension between profit-taking and bullish conviction.

Market mechanics reveal underlying strength. The compression in BTC volatility despite high derivatives activity suggests accumulation rather than distribution. This technical setup often precedes explosive moves, though direction hinges on macroeconomic cues.

All eyes turn to Jerome Powell. The Fed's 4.25-4.50% rate band has anchored crypto markets since December, with 100bps of 2024 cuts already priced in. Any deviation from the expected 'wait-and-see' stance could disrupt Bitcoin's correlation-breaking performance. 'Liquidity drives crypto more than rates,' notes a Bybit trader, 'but Fed surprises still shake weak hands.'

Bitcoin Whales Spooked by Threatening Dust Messages as Old Wallets Move Coins

Bitcoin's recent price surge has coincided with unusual activity among long-term holders. Whales holding large BTC stashes from the network's early years are suddenly moving coins—some after nearly a decade of dormancy. The most notable transfer involved 80,000 BTC shifting from multiple legacy wallets.

On-chain investigators discovered a disturbing pattern: many of these ancient wallets received 'dust' transactions containing pseudo-legal threats. The messages appear to be a new FORM of scam exploiting Bitcoin's op_return function. Targets weren't selectively chosen beyond two criteria—wallet age and substantial balances.

Even famously lost coins weren't spared. James Howells' wallet containing 8,000 BTC on a discarded hard drive received these meaningless legal claims. The campaign's timing suggests coordinated psychological pressure rather than legitimate enforcement action.

Saylor Unveils Bitcoin Defense Unit to Boost Accumulation

Michael Saylor, executive chairman and co-founder of MicroStrategy, has launched a Bitcoin Defense Unit aimed at accelerating corporate BTC accumulation. The move signals deepening institutional commitment to Bitcoin as a treasury reserve asset.

MicroStrategy's latest initiative reinforces its position as the largest public company holder of Bitcoin, with over 140,000 BTC on its balance sheet. The Defense Unit appears designed to counter regulatory and market pressures while optimizing acquisition strategies.

Is BTC a good investment?

Based on current data, BTC presents a compelling investment case:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +2.7% above | Bullish trend confirmed |

| MACD | Positive crossover | Momentum building |

| Institutional Holdings | $1.2B (Tesla alone) | Strong adoption signal |

William advises: "DCA strategies may outperform timing the market given BTC's volatility. The $100K-$125K range could serve as accumulation zone."

Past performance not indicative of future results